Budgeting for Business Success: A woman’s guide.

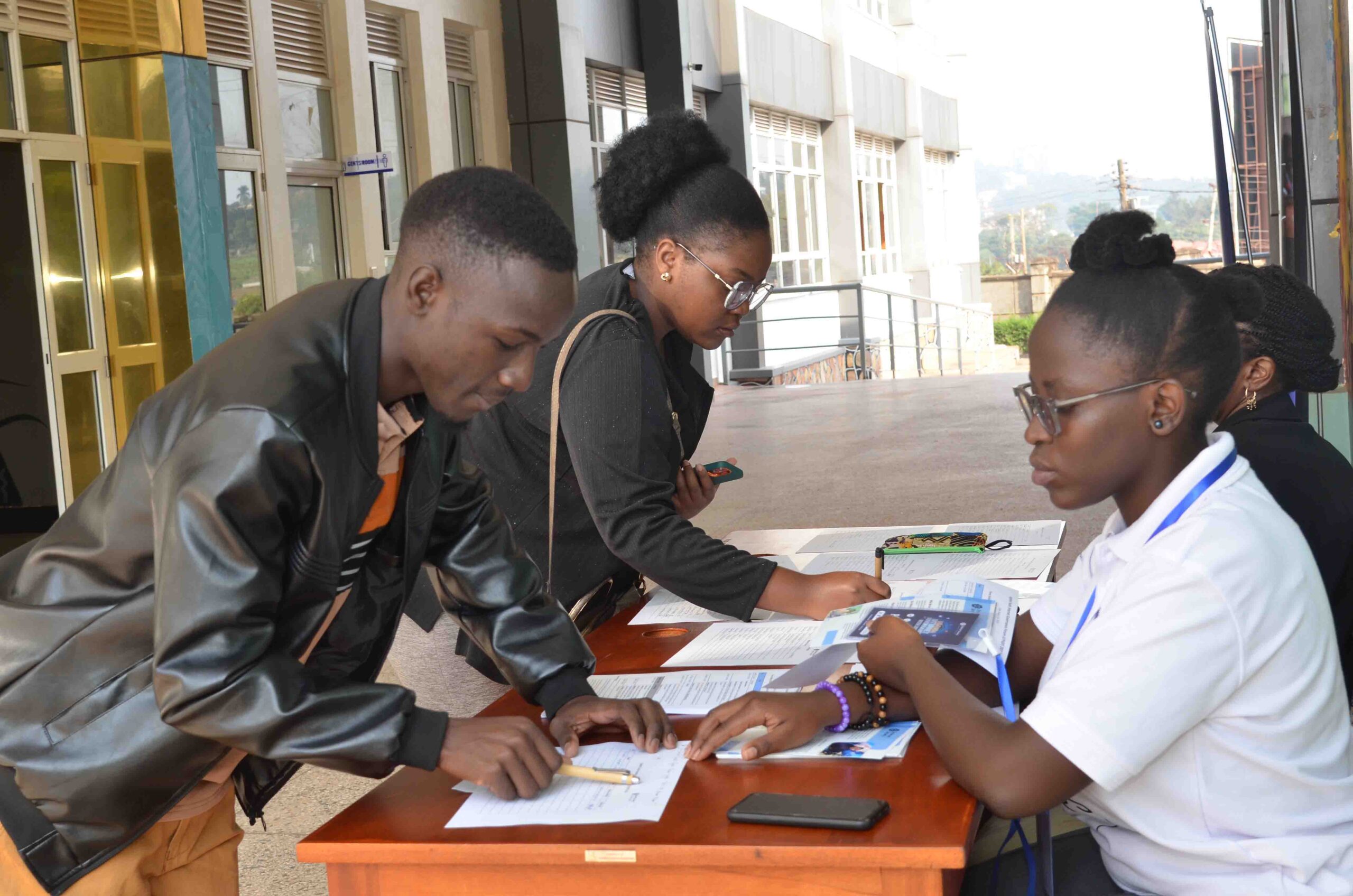

efiug beneficiary counts money after selling all her product

Published on Tuesday, April 12, 2022 by admin

Introduction:

Budgeting is essential for maintaining financial control and ensuring the profitability of your business. A well-structured budget helps you allocate resources efficiently, plan for future growth, and avoid unnecessary expenses. This guide will walk you through the steps of creating and managing a budget that supports your business objectives.

Step-by-Step Guide:

- Track Your Income and Expenses:

- Start by Gathering Financial Records:

Collect all relevant financial documents, such as bank statements, receipts, and invoices. This will give you a clear picture of your current financial situation. - Categorize Your Expenses:

Divide your expenses into categories like fixed costs (rent, salaries), variable costs (materials, utilities), and discretionary spending (marketing, travel). This helps in identifying where your money goes. - Use a Budgeting Tool:

Choose a method that suits you, whether it’s a simple notebook, a spreadsheet, or budgeting software. Record every transaction in detail.

- Start by Gathering Financial Records:

- Set Financial Goals:

- Identify Short-Term Goals:

These could include goals like reducing expenses by 10% over the next three months, saving for a specific purchase, or increasing revenue by a certain percentage. - Establish Long-Term Objectives:

Think about where you want your business to be in the next 3-5 years. This might involve expanding your operations, investing in new equipment, or entering new markets. - Align Your Budget with Your Goals:

Ensure that your budget reflects your goals. For example, if expanding your product line is a priority, allocate funds for research, development, and marketing.

- Identify Short-Term Goals:

- Plan for Unexpected Expenses:

- Create an Emergency Fund:

Set aside a portion of your income each month to build an emergency fund. This will help you manage unexpected costs like equipment repairs, legal fees, or sudden drops in revenue. - Review Insurance Options:

Consider purchasing insurance to protect against risks like fire, theft, or liability. Insurance can be a crucial part of managing unexpected expenses. - Adjust Your Budget When Necessary:

Regularly review your budget to accommodate any unexpected changes in your business environment. Be prepared to reallocate funds if necessary.

- Create an Emergency Fund:

- Review and Adjust Regularly:

- Monthly Reviews:

At the end of each month, compare your actual income and expenses with your budget. Identify any variances and understand the reasons behind them. - Make Adjustments:

If you notice consistent overspending in a particular category, consider making cuts elsewhere or finding ways to increase revenue. Flexibility is key to effective budgeting. - Seek Professional Advice:

If budgeting becomes overwhelming, don’t hesitate to consult a financial advisor or accountant who can provide guidance and help you stay on track.

- Monthly Reviews:

Tips:

- Be Realistic:

Don’t overestimate your income or underestimate your expenses. Being realistic will help you create a budget that you can stick to. - Avoid Unnecessary Debt:

Borrow only when necessary and ensure that any loans or credit align with your budget and financial goals. - Stay Disciplined:

Sticking to your budget requires discipline. Avoid impulsive purchases and regularly remind yourself of your financial goals.